Point‑of‑Sale Comparison Guide: Choosing the Right System for Your Business Modern point‑of‑sale systems have evolved far beyond simple cash registers. Today’s POS platforms act as the operational backbone of a business—managing orders, payments, inventory, staff, reporting, loyalty, and even marketing. With so many options on the market, choosing the right system can feel overwhelming. This guide breaks down the key …

Why Today’s POS Systems Deliver Faster ROI Than Ever

Is it time to elevate your restaurant’s point-of-sale solution? If you’ve ever wanted to upgrade your point‑of‑sale system but assumed it would be too expensive, it might be time to take another look. Modern POS platforms come with fast ROI opportunities that can pay for themselves quicker than most business owners expect — and in many cases, they actually unlock …

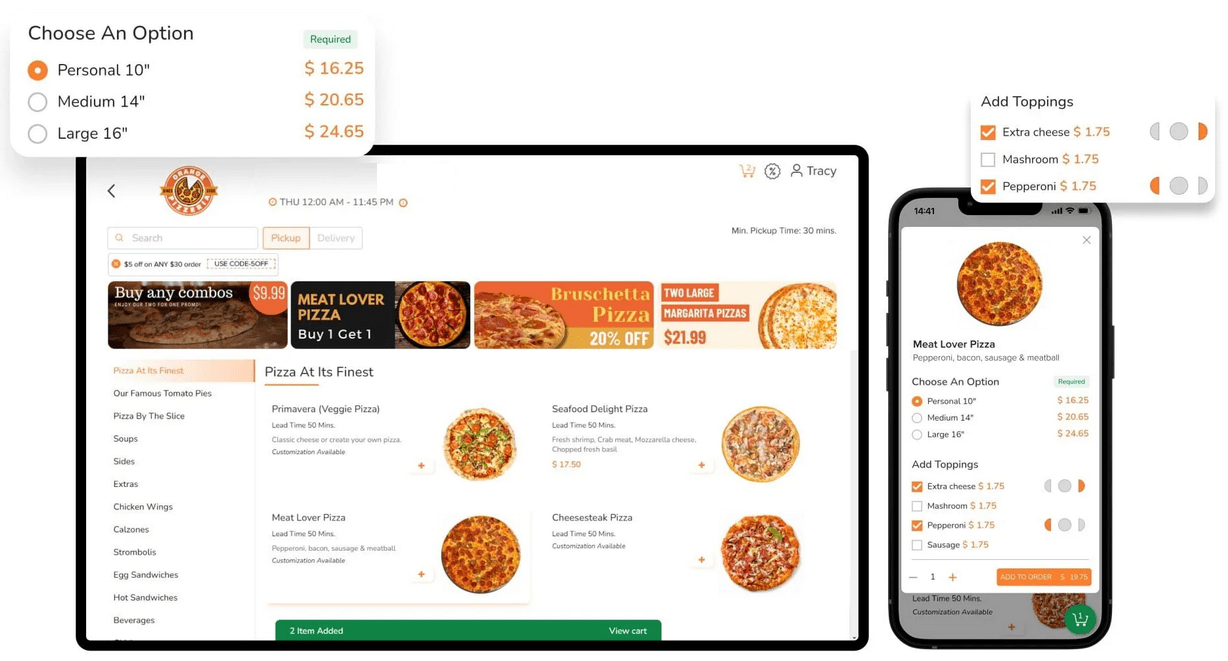

Why Restaurants Need Online Ordering & Branded Mobile Apps

Why Restaurants Need a Cloud POS System with Online Ordering and a Branded Mobile App In today’s competitive dining industry, restaurants must do more than serve great food—they need to deliver convenience, speed, and digital engagement. A cloud POS system with integrated online ordering and a branded mobile app is no longer optional; it’s the backbone of modern restaurant …

Is Your Restaurant Just a Number for Some Shareholder Report?

Stop Being Just a Number – Choose a POS Partner That Puts Your Restaurant First Running a restaurant is a beautiful blend of art and logistics. While your culinary creations draw in crowds, it’s the behind-the-scenes systems that keep everything humming. One of the most critical tools in your operational arsenal? Your Point of Sale (POS) system. Choosing the …

How to Choose the Right POS for Your Restaurant

Choosing the right POS for your restaurant shouldn’t be a daunting task. Check out these helpful tips! Running a restaurant is a beautiful blend of art and logistics. While your culinary creations draw in crowds, it’s the behind-the-scenes systems that keep everything humming. One of the most critical tools in your operational arsenal? Your Point of Sale (POS) system. …

Your Restaurant Deserves Better!

Why Your Restaurant Deserves a Smarter POS System — And Why Now Is the Time to Switch In the restaurant business, every second counts. Whether you’re flipping tables on a Friday night or managing inventory before the weekend rush, your point-of-sale system should be your most reliable teammate — not a source of frustration. Yet many restaurants are still …

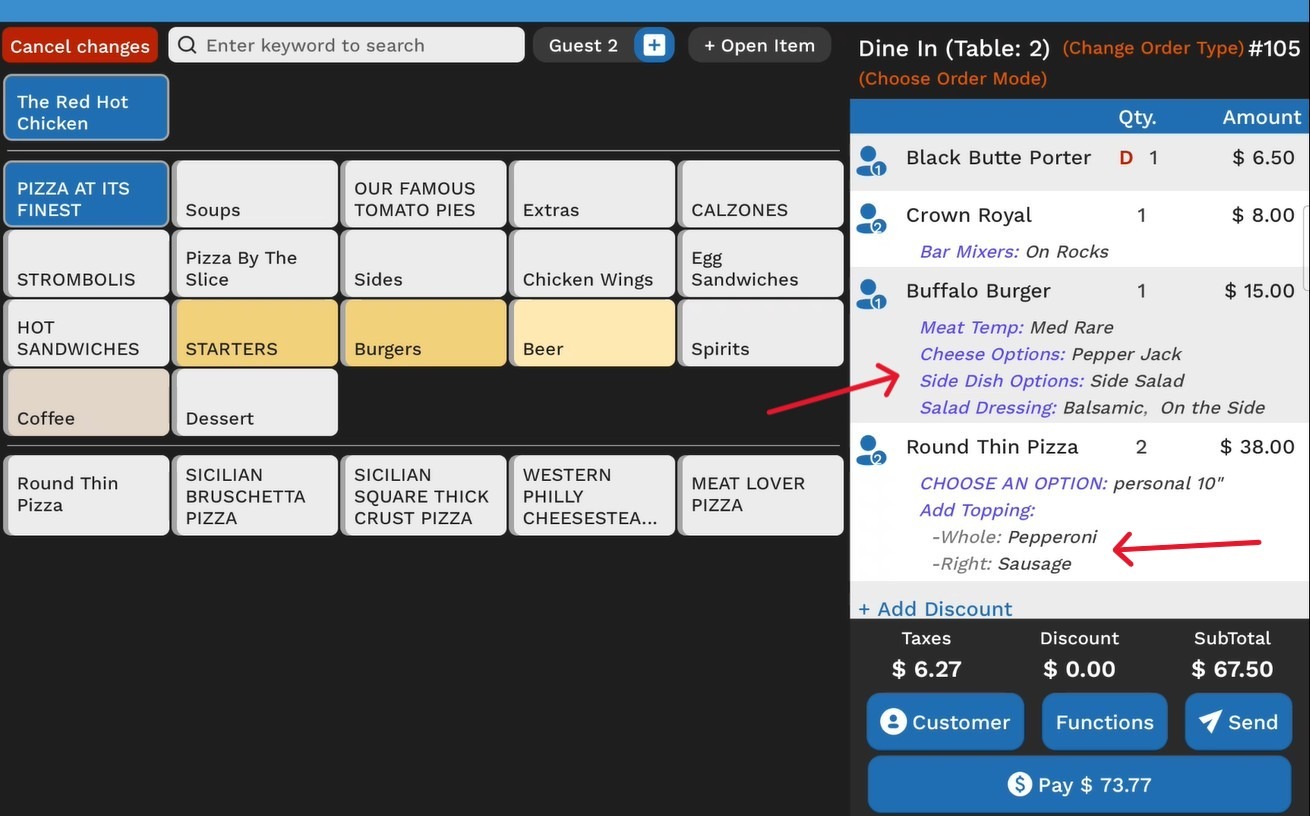

Still Wrestling with Modifiers?

Stop Losing Money Over Mistakes and Upgrade Your POS If your staff is fumbling through confusing modifier screens or your kitchen keeps sending out the wrong orders, your point-of-sale system isn’t just outdated—it’s costing you money. Modern diners expect personalization. Your team deserves clarity. And your bottom line demands efficiency. That’s where a smarter POS solution with custom modifier capabilities …

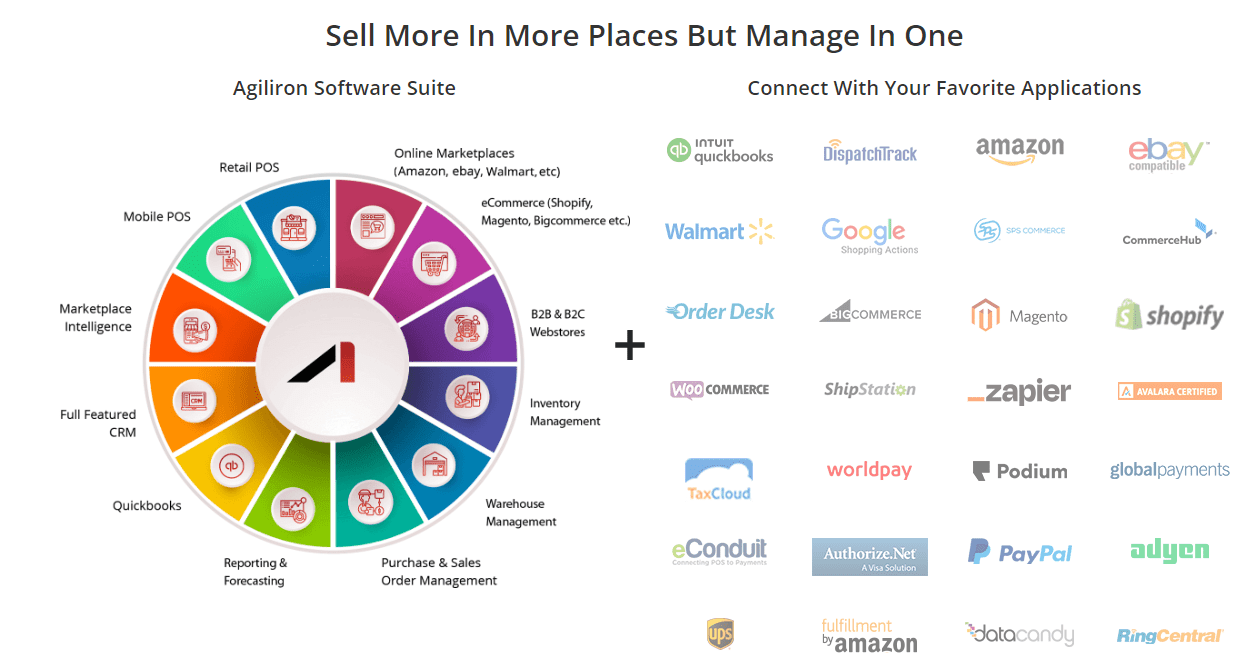

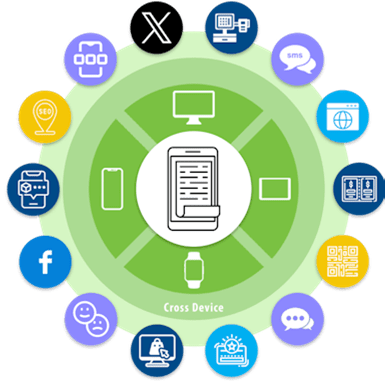

Agiliron Point of Sale Software

Throughout our history, SalePoint has offered products to the market in addition to our internally developed software. This allows us to address various industry verticals that require specialized solutions that our current products may not fit. We are happy to announce a new relationship with Agiliron out of Portland, Oregon. SalePoint is now reselling their software. Agiliron is a SaaS …

TransactionTree Digital Receipts Now Integrated with Trovato

Trovato has been integrated with TransactionTree for digital receipts and transaction history. The TransactionTree platform helps build a two-way relationship with your customer, deliver personalized content to drive sales and provide post-purchase support after the sale. You can find more information at https://www.transactiontree.com/solutions/clerkless/digital-receipt-solutions/.

SalePoint becomes Fiserv ISO

In order to better serve the industries, we sell to, SalePoint has partnered with Fiserv. This partnership provides cost competitive merchant services solutions as well as the ability to offer Fiserv’s Clover point of sale solution to those merchants that fit Clover’s functionality. This expands our solution offering to serve a wide range of customers including smaller retailers where the …